For the first few years of my career, I worked as a financial journalist. The magazine where I worked was a bit ropey - it made most of its money giving awards to banks then selling them adverts - but I enjoyed learning about the markets.

At their best, the capital markets are an amazing way of directing capital to those companies that deserve it. However, the markets are also prone to distortions and abuses, including a tendency to hype, bubbles, boom and bust, and zero-sum behaviour by executives and / or investors looking for a quick buck. That’s especially true in frontier markets, like psychedelics.

The idea of a ‘psychedelic stock market’ seemed far-fetched until just three years ago, when a slew of companies listed, led by the Compass Pathways IPO in September 2020 and the atai Life Sciences IPO in June 2021. Those two were big listings attracting institutional investors, but there were also many much smaller companies that listed, typically on the Toronto Stock Exchange, often by merging with already-listed mining companies. Some of these companies took advantage of the peak of the psychedelic hype cycle, and raised capital with little more than a press release.

Christian Angermayer, the leading investor in Compass and the founder of atai, warned that the psychedelic stock market was attracting a lot of opportunists. In a December 2020 post he wrote:

My deep worry is - looking at some stock market listed companies, especially on exchanges known for pump-and-dump schemes - that promotors with little or no biotech experience and very little or no self-generated scientific research behind their company’s compounds are pushing very hard to attract quick retail money.

A pump n’ dump scheme is when someone starts a company, spends big on publicity, lists on an exchange, and then sells their stake immediately, leaving retail investors holding the bill. It’s not illegal, unless the executive can be proved to have knowingly misled investors - but it’s not very ethical. Many entrepreneurs start companies, ramp them up and then exit, but usually they wait a few years to exit, and try to leave the company in decent shape for the next owners.

Angermayer suggested a check-list by which retail investors could decide if a psychedelic company was a good long-term investment or a quick cash-in at their expense. Two of his warnings were:

Is the PR budget bigger than the R&D budget? (always a bad sign…)

Is the company paying for articles?

Around the same time as the first wave of psychedelic stock market hype, a lot of psychedelic media companies appeared to provide content on the psychedelic industry, like Microdose, Psychedelic Spotlight, Psychedelic Finance and The Dales Report, with market coverage also provided by companies like Benzinga and Forbes.com. If you follow psychedelics, you’ve probably seen content from these media companies shared on social media. You may not have realized how much of that content is paid-for by the executives being interviewed. In addition, many psychedelic media companies are owned or part-owned by psychedelic venture capital funds who do not necessarily have an interest in providing accurate news about the risks of their psychedelic investments or psychedelics in general.

In other words, the psychedelic information ecosystem is largely funded by psychedelic corporates and venture funds, who use it to promote their stocks, or the industry in general. There is little independent or critical reporting or research, because the mainstream financial press and investment researchers don’t cover these small companies. That’s just how it is – but hapless retail investors may not realize the content they consume is paid-for, as it’s not always clearly shown as such, and people wondering whether to try psychedelics and choosing a clinic or retreat may be directed to companies more focused on profit than care.

Let’s look at some examples of psychedelic media outlets.

Microdose / Wonderland

Microdose presents itself as ‘the leading guide to the business of psychedelics’. It runs Wonderland, an annual psychedelic conference in Miami, which it calls ‘the world’s leading event on psychedelic medicine, mental health and longevity’. Microdose is part-owned by the Conscious Fund and Negev Capital, both of which are psychedelic venture capital funds. It offers psychedelic corporates a range of sponsored content options – CEO interviews, keynote addresses at its events, featured articles, social media content, public relations, brand storytelling, and so on. It may appear to be an independent media company to the casual media consumer on social media, but it’s (also) a PR company. I asked its CEO Patrick Moher how much they charge companies to appear in features or events, and whether he thinks it’s always clear to their audience when content is paid-for, but didn’t hear back yet.

Psychedelic Invest

Psychedelic Invest says it’s ‘a resource for those looking to invest in the burgeoning psychedelic industry’. It’s owned by Iter Investments, a psychedelic venture capital fund, which launched a suite of companies called Nucleus, including Psychedelic Invest, to offer marketing to players in the psychedelic space. Psychedelic Invest offers a range of content, like its podcast, its Mind-Shifting Moments, Company Showcases, and the ‘Investor Hotseat’ – video interviews of psychedelic CEOs by Dustin Robinson, founder of Iter Investments fund. Psychedelic Invest also offers companies the chance to ‘showcase’ to its audience. It’s not clear what showcasing involves and what content on its site is paid-for. I asked Dustin if CEOs pay to go on the ‘Investor Hotseat’ – he says no, and says Iter has no input on Psychedelic Invest’s news coverage. He does at least put retail investors’ questions to CEOs during these ‘hot-seats’.

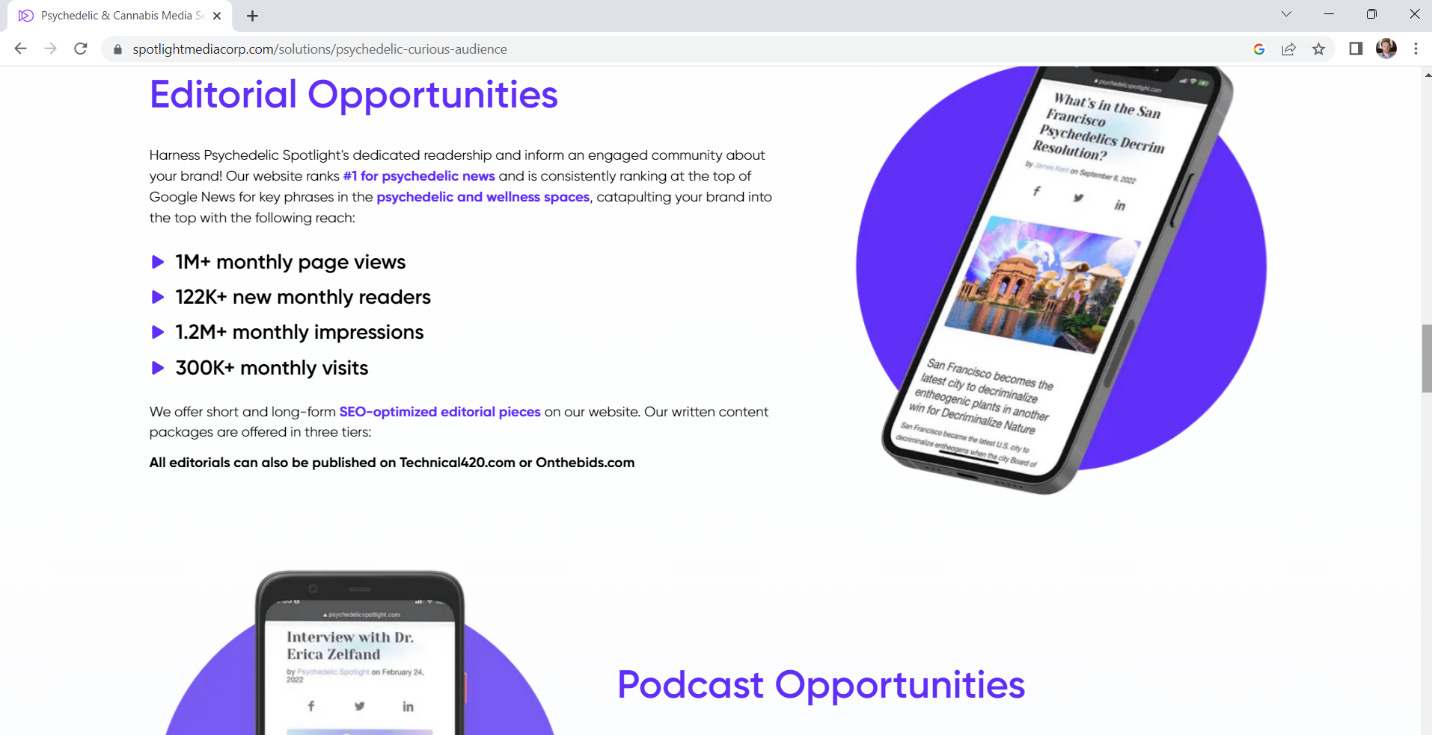

Psychedelic Spotlight

Then there’s Psychedelic Spotlight, another website and content creator. It’s owned by a Las Vegas company called Global Trac Solutions, which recently changed its name to Psych. Psychedelic Spotlight says: ‘Our mission is to help people obtain a reliable source for the latest stories in the emerging psychedelics industry’. Sounds like a news company, right? But its website also advertises its PR / investor relations service, through which companies can pay to reach a ‘psychedelic curious’ audience and have articles and social media posts about them and podcast interviews with their leadership. Again, it’s not clear what content is sponsored and what isn’t – I presume if content features a company, that company has paid for it. I asked its CEO, David Flores, but didn’t hear back yet.

The Dales Report

The Dales Report was founded in late 2019 by Shadd Dales, and bills itself as offering: ‘Investing strategies for traders focused on Stocks, Web3, and the Business of Cannabis & Psychedelics!’ Once again, it sells the opportunity to be interviewed by Shadd. That’s not obvious if you see one of its video interviews on social media, but if you click through to its website you find this disclosure:

The Dales Report (TDR) periodically accepts fees for content creation and sponsorship from public companies featured on this website. This may include upfront cash payments and/or equity compensation as part of a standard agency agreement for paid media representation. TDR may also publish content for companies where an agency agreement had previously been established.

Look at that video description – CEO ‘joined us to talk about how their company is planning on releasing a number of announcements’. Now that is hot news. Anyway, Shadd tells me over 90% of their content is non-paid, and only one of their clients is a psychedelic company at the moment.

Psychedelic Finance

There’s not much public information about Psychedelic Finance, who owns it, or who works there. It offers a ‘free newsletter to help investors discover, understand and stay up to date with the business of psychedelics’, and produces research on psychedelic companies, but also advertizes itself as a digital marketing agency. MindCure, one of the first psychedelic companies to go bust, paid Psychedelic Finance to promote it with interviews like this (note, no indication it’s ‘sponsored content’).

There’s also Benzinga, which looks like an independent media news company but also sells sponsored content – and once again, you often can’t tell what is sponsored and what isn’t.

Almost every psychedelic media company is owned or part-owned by a psychedelic investment company. Healing Maps has a contractual relationship with Healing REIT (which leases real estate to psychedelic clinics); Third Wave took convertible investment from Conscious Fund and Forward Vision Fund (though I’m told Conscious Fund doesn’t have a stake now); The Trip Report is owned by Beckley Waves; Reality Sandwich was bought by DELIC; DoubleBlind and Lucid News are part-owned by the founders of the JLS Fund. I have no idea to what extent journalists on these publications are left alone to write what they want – they don’t seem to offer sponsored content quite as brazenly as their competitors and I know and trust some of the journos who write for these sites. Ken Jordan, founder of Lucid News, tells me:

We've made clear to all of our investors -- as we have to our sponsors -- that Lucid News maintains a firewall between business, including investors, and editorial. As an independent news operation, we can't operate any other way. And all of our investors and sponsors are comfortable with that policy. Not once have the people at JLS, or any of our investors, attempted to influence our editorial process.

Psychedelic Alpha and Psymposia are independently-owned while newsletters like Psychedelic Week, The Bigger Picture, Liminal News, On Drugs, Blossom and Brave New World are reader-paid. Berkeley’s Microdose is affiliated to an academic project which received a $1.25 million anonymous grant (Tim Ferriss?) As for us, we’re reader-paid, although also affiliated to the Challenging Psychedelic Experiences research project, which receives funding from the charity Emergence Benefactors.

Many psychedelic-orientated podcasts also offer executives the chance to buy a guest appearance, or are presented by people paid by or financially tied to psychedelic companies. The Psychedelic Therapy Frontiers podcast is owned by Numinus, Business Trip is owned by PsyMed. There’s also MAX Afterburner, a psychedelics-promoting podcast presented by Airforce veteran Matthew ‘Whiz’ Buckley, who is an advisor to psychedelic real estate firm Healing REIT. Here’s a video of its chairman, Joe Caltabiano, and Whiz being grilled by Shadd Dales:

Let’s not be too precious about this – every media company is owned by someone, and business publications always exist in close symbiosis with the industries they cover. But investors depend on reliable information, and so do consumers wondering which psychedelic retreat or clinic to trust with their souls. And the psychedelic market is frothy to say the least – one editor tells me they were offered tens of thousands to write positive pieces by companies, and even more if they took the payment in company stock. That’s a strong temptation to write a glowing feature about the latest psychedelic-corp.

I’m going to dive into three companies – MindMed, Wesana / Lucy Scientific Discovery and Psycheceutical - to show how they use marketing hype to attract retail investors. Note – this is not illegal and I am not claiming these companies are doing anything illegal.

MindMed

MindMed was founded in 2019 by Y-Combinator alumnus Jamon Rahn. It was the first psychedelic company to list on a stock exchange, through a reverse takeover of a mining company on the NEO Exchange in Canada. It was also the first psychedelic company to have a market capitalization over a billion dollars. It listed on the Nasdaq in April 2021, and spent big on marketing in the run-up to that listing – in fact, it spent almost twice the amount on general costs (including PR and investor relations) as it did on R&D in 2021.

What did it spend its marketing budget on? Well, we know they hired a company called Departure Capital, which boasts of its ability to drive up companies’ share prices by ‘blasting’ social media. One of its clients was MindMed (thanks to Jake Slomowitz for this screenshot). Notice how part of the hype is ‘informing investors about the mental health crisis’ - I’ve seen YouTube stock hypers say that one in two people have a mental illness requiring psychedelic treatment!

It also got a lot of great press from a YouTube commentator called James Hallifax, who had a channel called PsycBIZ and who declared MindMed ‘the next Tesla’. He’s since been nominated for reporter of the year at Microdose and his company was bought by Psychedelic Spotlight.

All this positive news attracted the retail investors, including then-23-year-old newbie Jake Slomowitz. He tells me: ‘I was really into MindMed. I thought psychedelics were going to change the world and MindMed was the company that would do it. I even wore a MindMed jumper!’ Jake invested ten thousand of dollars into MindMed, then watched in horror as the share price crashed 30% the day of its Nasdaq listing. Worse still, the CEO and founder, Jamon Rahn, sold 40% of his stock a month after the listing, and left the company two months after. Benzinga got an ‘exclusive’ interview with Rahn and dutifully reported him explaining why it was time for new leadership, but failed to ask him why he’d sold so many shares. Since listing, MindMed stock has lost 97% of its value (although it still has plenty of cash and could rebound). Jake tells me he lost $7,700 in his investment and now takes a much harder look at the psychedelic companies he invests in.

Wesana Health

Keep reading with a 7-day free trial

Subscribe to Ecstatic Integration to keep reading this post and get 7 days of free access to the full post archives.